Forex is the world’s largest trading market, open 24 hours a day, five days a week. It’s also the most volatile market, which means there’s a better chance of making a lot of money. The US dollar and/or other worldwide currencies make up forex currency pairs.

The base currency is the first currency in a pair, such as the British pound in GBP/USD. The quote currency is the second currency, which in this case is the US dollar. The base currency is often the trader’s home currency.

A forex currency pair’s price is the amount of the quote currency required to purchase one unit of the base currency.

EUR/GBP 1.45, for example, means that £1.45 is required to purchase one Euro. A EUR/USD exchange rate of 1.89 means that $1.89 will buy one Euro.

Traders can trade with much more leverage and lower margin requirements than they do in equities markets. However, before diving fully into the fast-paced world of forex, you’ll need to understand the most commonly traded currency pairings.

Here are six of the best forex pairs in the market.

Table of Contents

Euro/USD

The EUR/USD currency pair has a negative correlation with the USD/CHF currency pair and a positive correlation with the GBP/USD currency pair. This is owing to the euro’s, British pound’s, and Swiss franc’s positive correlation.

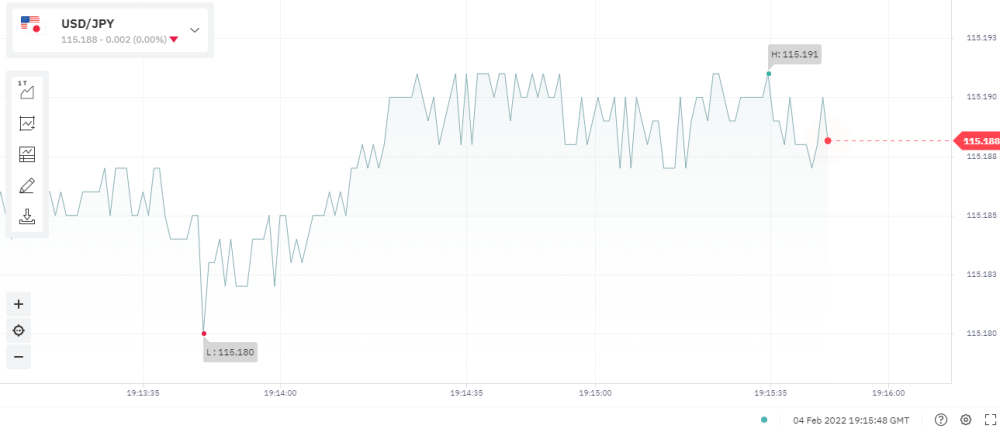

USD/JPY:

USD/JPY: Political tensions between the United States and the Far East have been a source of concern for this pair. Because the US dollar is the base currency in all three pairings, the pair tends to be favorably connected with USD/CHF and USD/CAD.

GBP/USD

The GBP/USD pair has a negative relationship with the USD/CHF but a positive relationship with the EUR/USD. This is owing to the strong relationship that exists between the euro, British pound, and the Swiss franc.

AUD/USD

Due to the fact that the US dollar is the quote currency in these circumstances, the AUD/USD currency combination has a negative correlation with the USD/CAD, USD/CHF, and USD/JPY currency pairs. Because the Canadian and Australian dollars are both commodities block currencies, they have a positive association with each other.

USD/CAD

Because the US dollar is the quote currency in these other pairs, the USD/CAD currency pair has a negative correlation with the AUD/USD, GBP/USD, and EUR/USD.

USD/CNY

The USD/CNY currency pair denotes the exchange rate between the US dollar and the Chinese renminbi, also known as the yuan. It has accounted for around 4% of daily currency deals in recent years.

In recent years, the US-China trade relationship has been unpredictable, giving USD/CNY traders a wealth of speculative chances.

Get this tool, Increase your winning rate in Forex

One Easy Tool Forex — Trading Success Discovered

You can Also Read 8 Realistic Ways to Start Making Money Online in 2022